April 2010 Newsletter

Our monthly email newsletter reports on the state of the Melbourne Real Estate market, keeps you informed and up to date on what's happening at JPP Buyer Advocates, as well as presenting some of our recent success stories. to

Subscribe, send an email to:

[email protected]

to un-Subscribe, send an email to:

[email protected]

|

Staff News |

What a year so far -

JPP would like to Welcome & introduce Warren Parker to our team.

We are also happy to welcome Justin Lilburne back to JPP.

Courtney has also given her very loved Rag doll Cat "Dax" a brother & sister (2 young puppies named Bonnie & Clyde)!!

As our team just keeps growing feel free to call at anytime to arrange a no obligation meeting with one of our advocates.

Sam James

Top

|

Market Overview |

With the expected fall in median house price issued by the REIV and reported by all the papers, we saw a lacklustre weekend. We know there was still a clearance rate of 84%, but of most of the auctions our advocates attended there was a decided lack of enthusiasm. Even some of the agents were a little unsure at the lack of bidding. Most people who read the papers tend to have a knee jerk reaction whenever there is a drop in the Median house price.

This one, however, was expected. With the scaling back of the First Home Owners Grant, there are less low end property purchasers. The interest rates also affect the lower end of the market first. This has the effect of lowering the median house price decisively. If we look at the top third of suburbs in Melbourne, however, there has been significant growth and there will be for many years to come.

As interest rates climb toward the average home owner paying about 8.5% the suburbs on the outer areas of Melbourne will slow significantly and we may see another drop in the 2nd quarter median as well. Conversely, I would think there will be a small growth in the inner 20k ring of suburbs over the same time frame. If you break down the figures that have been released, whilst the house price median dropped slightly, the unit median went up.

Investors don't need to have a huge yield (rental return and depreciation and tax benefits) to make plenty of money in property. It is all about capital growth. And there is still plenty of growth to come in the top third of suburbs in Melbourne.

Ian James

March 2010 Metropolitan Melbourne Median Prices

|

|

Mar Qtr 2010

|

% chg Dec-09 to Mar-10

|

Dec Qtr 2009

|

% chg Mar-09 to Mar-10

|

Mar qtr 2009

|

% chg Mar-05 to Mar-10

|

Mar Qtr 2005

|

|

Houses

|

$524,500

|

-2.0%

|

$535,000

|

29.5%

|

$405,000

|

52.0%

|

$345,000

|

|

Units & Apartments

|

$450,000

|

2.0%

|

$441,000

|

25.0%

|

$360,000

|

54.6%

|

$291,000

|

(source: REIV)

I don't need to tell anyone the market is hot at the moment. But what most media commentators report about and many people in the public believe, is that the market will slow down. Therefore it is better to wait until this happens and then purchase. Unfortunately, this is incredibly unlikely to occur.

The market is in a very imbalanced state. Whilst there are plenty of properties on the market there is a far greater number of people trying to purchase. This imbalance will be in effect until there is a paradigm shift in the thought process of local and state government. We simply need to be able to house more people. We do not have enough dwellings to house our growing population.

And the answer is not to stop immigration. If we stop immigration whilst we have low unemployment and job advertisements climbing as high as they are, then we will simply fall back into recession or worse. Our economy in both Australia and this State are in excellent shape to be able to repay the massive debt the federal government has racked up in the past three years.

The answer is not raising interest rates. If Glenn Stevens continues to raise interest rates then he is simply hurting the people we need most. We need small property developers building new dwellings. We need developers building more dwellings at sites like the Camberwell Railway Station. We need more medium to high density housing.

We cannot simply house one million people somewhere out near Melton. We cannot afford the infrastructure. We cannot shut off the influx of migrants to our city because we need them to fulfil job vacancies. But we need to alleviate the speed with which property prices are rising.

Justin Madden, our embattled planning minister, may not be perfect, but he is simply being targeted as a scapegoat. Someone needs to make the tough decisions and whilst I have not looked at everything he has done, nor do I fully understand all the way some of the decisions have been made, we need a planning minister who will make development happen.

We are not looking at property prices doubling from what they are now in 10 years. We are looking at these figures in around five to six years. For those of you who have children and think they will be moving out anytime soon: think again. If the average house in Melbourne is $1M then the rent an investor needs to make the investment worthwhile is about $40,000 p.a. or nearly $770 per week. If an investor doesn't get this sort of return then we will find slums being created. An investor will protect his dollar return before the tenants needs.

Our housing price crisis is not just going to affect those who wish to purchase a property; it will be affecting those who need to rent as well. Whilst basic human instinct is to first get food, the second survival instinct is for shelter. People will spend money on food then everything they have left on shelter.

There are two ways to avert slums and ghettos being created in Melbourne. The first, which is not very palatable, is to keep raising interest rates. This will stifle business growth, raise unemployment and therefore trigger a massive reduction in immigration. It will also cost many of us our livelihoods and our futures. But it will create a balance between supply and demand in the housing market.

Alternatively, the state and federal governments can actively and "intelligently" promote greater density development within the current boundaries of the Melbourne Metropolitan area. We need to see red tape slashed, we need to see incentives for investors to purchase investment properties such as the First Home Owners Grant for investors. We need to see grants given to developers to assist them to get finance so they can build more developments.

"Mum and Dad" investors need to be given incentives to develop the "quarter acre block" they have owned for thirty years, into four townhouses. They can retire into one and the other three will be available for our growing population.

Mr Brumby needs to act NOW! By the next election in four years it may be too late. We need to keep Melbourne as the world's most liveable city. It will no be so within the decade. Very few people will be able to afford to live here.

Ian James

Top

|

Spotlight on Melbourne Suburbs |

In our regular spotlight section we examine a selection of Melbourne

suburbs, highlighting what's happening in these areas right now.

Municipality:

City Of Newport

Population: 11,244 (2006 census)

Postcode: 3015

Location: 7 km from Melbourne CBD

Newport is 7 km south west of Melbourne,

A nice drive over the Westgate bridge will put you in this nice quiet suburb.

Newport Power station is a well known feature of the suburb, the smokestack of which remains one of the tallest towers in Melbourne at 183 metres, can be seen from afar.

Victoria University maintains a campus in Newport, which focuses on automotive, metal fabrication, building and electrical trades.

The Newport campus hosts the Centre for Curriculum Innovation and Development.

The Geelong and Melbourne Railway Company opened the line to Newport in 1857 from Geelong, but it ran along North Road to a temporary terminus at Greenwich as the line on to Melbourne was not yet complete. In October that year the line towards Williamstown was completed, and so the Geelong line was connected to it. In 1859, the Williamstown line was finally completed to Melbourne, and Newport station opened on March 1, 1859 as Geelong Junction. It was renamed Williamstown Junction in 1869 before being renamed Newport in 1881. In 1887, the Newport-Sunshine line was opened to provide easier access to the port of Williamstown from the north of Victoria. A number of sidings were provided in the area, to a flour mill on the Melbourne side, and a goods yard on the western side of the Williamstown line. The level crossing at Melbourne Road was replaced with the current overbridge in October 1960, and in 1966 the freight line behind platform 1 was provided. In 1995, the Western standard gauge line to Adelaide was completed though the station. Newport was upgraded to a Premium Station on July 18, 1996.

Newport's properties are mixed in style period & price, with many beautiful parks & gardens through this lovely suburb.

Whilst there are still many beautiful period homes, there is also a large amount of new building happening,

many townhouses for the people wishing to have little or no maintenance issues, whilst living so close to the CBD for a reasonable price.

While there have been a couple of multi million dollar sales recently for larger land it will not be long before this area's median price is up there with some of the best...

Historic Williamstown, Melbourne's first suburb, and Spotswood - home to the fascinating Science works - flank Newport. All three suburbs are part of the Hobsonville municipality which presides over the head of Port Phillip Bay.

Median House Prices

| |

Lower

Quartile |

Dec 08

Median |

Upper

Quartile |

Dec 09

Median |

Annual

Change |

| Newport |

$525,000 |

$513,500 |

$713,000 |

$601,500 |

17.1% |

|

Source: REIV. December 2009 |

Median Unit Prices

| |

Lower

Quartile |

Dec 08

Median |

Upper

Quartile |

Dec 09

Median |

Annual

Change |

| Newport |

$450,000 |

$500,000 |

$582,000 |

$510,000 |

2.0% |

|

Source: REIV. December 2009 |

Photo's from Wikipedia under the

Creative Commons Licence

Sam James

Top

|

Recent Articles Of Interest |

April Interest Rates

The Reserve Bank of Australia has decided to increase the cash rate to 4.25 per cent at its monetary policy meeting today. Given the comments of the Reserve Bank Governor a week ago this will come as no surprise to anyone. It is also clear from his comments last week that more rate increases should be expected if current economic circumstances prevail.

The comments below, extracted from the official RBA statement, elaborate on the reasons for the decision.

"The global economy is growing, and world GDP is expected to rise at close to trend pace in 2010 and 2011. The

expansion is still hesitant in the major countries, due to the continuing legacy of the financial crisis, resulting

in ongoing excess capacity. In Asia, where financial sectors are not impaired, growth has continued to be quite

strong, contributing to pressure on prices for raw materials. The authorities in several countries outside the major

industrial economies have now started to reduce the degree of stimulus to their economies."

"Australia's terms of trade are rising, adding to incomes and fostering a build-up in investment in the resources

sector. Under these conditions, output growth over the year ahead is likely to exceed that seen last year, even

though the effects of earlier expansionary policy measures will be diminishing. The rate of unemployment appears to

have peaked at a much lower level than earlier expected."

"With the risk of serious economic contraction in Australia having passed some time ago, the Board has been

lessening the degree of monetary stimulus that was put in place when the outlook appeared to be much weaker. Lenders have generally raised rates a little more than the cash rate."

"Interest rates to most borrowers nonetheless have been somewhat lower than average. The Board judges that with growth likely to be around trend and inflation close to target over the coming year, it is appropriate for interest

rates to be closer to average. Today's decision is a further step in that process."

The problem in the local housing market is that the most significant factor driving recent price rises is not the

availability of funding rather it is severe shortage of homes. This rate increase will not help redress that

situation as it only increases the cost of housing without increasing supply.

Source: REIV

Real Estate Institute of Australia Housing Affordability Report

According to the Real Estate Institute of Australia Housing Affordability Report it became more costly to buy or purchase a home in the December quarter 2009 in Victoria.

This fact won't surprise any mortgage holder or any buyer in the marketplace.

In the December quarter last year the average proportion of a family income required to meet average loan repayments was 29.5 per cent, an increase on the 28.2 per cent that was required in the September quarter.

Read the rest of the story here

Sam James

Top

|

A Few Wise Words For The Investor |

The news is full of stories reflecting the current demand and supply issues surrounding Australian residential property. Although some of the reports have been exaggerated by the general hype surrounding the issue of foreign investment into residential property

- the bottom line is our population is growing and our infrastructure is a long way from meeting the need.

According to the Australian bureau of statistics, in June 2009, Melbourne had an estimated 4 million people. This is an increase of 93,500 people (or 2.4%) since June 2008. Further more, in 2008

- 2009 Melbourne recorded the largest growth of any other capital city for the past eight years. And the stats currently show we have over 1,700 people moving into the city each week. Assuming this level of growth continues

- and there is nothing to indicate it won't - we can expect Melbourne's residential real estate prices to climb at

'accelerated' levels at least for the foreseeable future.

Because of our rising market there are numerous courses, seminars, DVDs and books promising easy returns from real estate with minimal effort and cost.

Rising markets bring out the woodwork all sorts of property 'experts' claiming they'll make you into Donald Trump in less than a year. Some of my previous clients have recently contacted me asking for advice from seminars they've attended which offer

'too good to be true' proposals. These seminars usually come at a cost - sometimes charging in excess of $1000 to attend. They are run by spruikers who walk away with pockets lined and should be viewed with a large degree of scepticism. Read through the BRW rich list and you'll discover those who have successfully invested in property didn't do so over night

- the investments were always accompanied with a long term plan.

Purchasing property is not a 'get rich quick' promise and ideally should always be viewed as a long term commitment. Just looking at the costs involved in buying and selling real estate indicate property should ideally be held for a period of 7

- 10 years. Therefore it's essential that the reasons for investing in real estate are entered into on a well thought out strategy and not on a whim to make a fast buck. One of the biggest mistakes most inexperienced investors make is underestimating the on going costs involved in holding property or entering into it for the wrong reasons.

When I first started my real estate career I recall a property manager telling me that for every new rental property she managed she made sure the vendor had enough funds set aside to manage the on going maintenance costs. I can now fully appreciate the wisdom of those words. Units and apartments generally have less maintenance issues than houses, however just like insurance, the unforseen needs to be budgeted for.

These unforseen costs usually come out of the monthly rental cheque and therefore, it's vital to have a

'buffer' set aside to cover the short fall in loan repayments. Borrowing to the max without taking this into account will result in disaster, and expecting to cover all costs from the rental yield leads to disappointment. There are plenty of horror stories about bad tenants vacating property without notice and leaving the home in poor condition causing stress and needless expense

- The wise investor realises that it's more important to secure a good long term tenant that looks after the property and pays their rent on time than it is to chase a high yield or cut back on maintenance costs. For this reason it is highly advisable that a good property manager is engaged to look after the property and carry out regular inspections

- this needs to be budgeted for from the outset. Rental returns are currently around 4% and although they are will rise over a period of time, it would be a mistake to purchase for rental income alone.

On this note beware of property developers who offer rental guarantees to make the property more attractive to any would be investor. These properties are usually over valued in the first place. Here is one example of how it works

- a house reasonably worth $350,000 is offered for $375,000 with a rental guarantee of a 6% for the first year when in reality the going rate is only 4% The developer will cover the short fall in rent for the first year, and still make a profit of roughly

$20,000 however the unsuspecting purchaser is left with significantly less rental income at the end of the promised term and poor short term growth due to paying too much initially.

Factoring in expected interest rate rises is also wise. Glen Steven's recently said:

"It's a mistake to assume risk less, easy and guaranteed way to

prosperity is to leverage into property."

The message is loud and clear, interest rates will continue to rise and the purchaser should prepare accordingly. This doesn't mean the investment is a bad one. Property will continue to increase in value, and investors will be able to use the equity to leverage against other acquisitions, however any commitment shouldn't be made if you're going to be on a knife edge each time the reserve bank of Australia meets.

Negative gearing and tax benefits are another oft spruiked incentive to purchase. Out of pocket costs between the rent and annual expenses can be used to reduce over all taxable income. However whilst it's a helpful contributor to the holding costs, it should not be a lone reason to purchase. Note that only the interest is tax deductible, not the principle component, so you may be $5000 out of pocket at the end of the year, but only receive back $2000. (Talk to your accountant for further details surrounding this subject).

The reality is properties cost money to hold and the only potential gain is long term capital growth. If you have your eyes open and can weather the holding costs for the first few years the returns are extremely attractive. At a very conservative level well located residential property will safely grow 10% per annum. In ten years time a $440,000 investment property will be worth in excess of $1Mil and after 20 years over

$2.5Mil.

Look at holding the property for 3-5 years before it becomes 'revenue neutral'. Concentrate on getting a good long term tenant and doing incremental increases in the rental price at the end of each term. A final word for all those who are warning our market is no more than a bubble. The continuing influx of investors from foreign lands, our naturally increasing population coupled with a strong Australian economy and shortage of homes, suggest the value of property will continue to rise for the foreseeable future. The current forces surrounding supply demand cannot be reversed or alleviated over night, and no one in power will act on any incentive which will risk Melbourne real estate dropping dramatically in value. Property by all accounts is a safe long term investment. The CEO of the REIV sums it up nicely.

"Common perception may be for buyer's interest to cool off in the

face of projected interest rate increases however that perception does

not take into account the underlying factors driving the market - a

significant gap between the housing needs of our growing population and

our ability to provide them the homes they need to live in." - Enzo Raimondo

The biggest challenge faced by today's property investors is understanding how to purchase the right property for the right price in a rising market flooded with buyers. The cost of a buyer advocate is roughly 1.5% of your over all budget. For the sake of securing potentially the best investment you'll ever make, it is well worth seeking professional expert advice from a company with proven results.

Catherine Cashmore

Top

|

Technology Monthly |

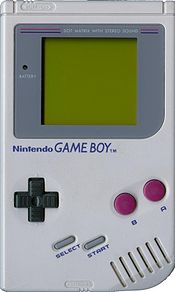

Retro Review - Nintendo

Note - When I started writing this, it was going to be a review of the Nintendo

Entertainment System, which was Nintendo's first cartridge based home console,

but as I started doing research, I discovered what an interesting past Nintendo have and chose to write about the company itself instead. I will do a review of the console itself next newsletter.

Nintendo is actually quite an old company, it was founded in 1889 by Fusajiro Yamauchi in Kyoto, Japan and was then called Nintendo Koppai, they

produced handmade hanafuda cards

which are Japanese playing cards. They also tried many smaller niche

businesses such as a taxi company, TV network, food company and even a

love hotel. In 1977 Nintendo produced their first video game system - Colour TV Game, they produced four different versions

of this machine, each playing variations of a single game (such as pong & breakout).

Around this time a student product developer named Shigeru Miyamoto was hired to design the casing of several cases for the Colour TV Game, this man pretty much made Nintendo

what it is today and it would take many pages to list all his life's work, but he was most known for designing both the Mario games and the Zelda games. If you would like to read more about

him, click here.

Handhelds - In 1980 Nintendo launched the Game & Watch series of handhelds which were handheld units that played single monochrome games, they followed this with the Gameboy to which there

have been many models including the Gameboy, Gameboy Pocket, Gameboy Colour, Gameboy SP, Gameboy Advance & Gameboy Micro and these of course led to the creation of the Nintendo DS

of which there have been three models: Nintendo DS, Nintendo DS Lite and the Nintendo DSi and there will be a new one this year called the Nintendo DSi XL, which is a larger version of the Nintendo DSi.

Consoles - In 1985 Nintendo released the 8-bit Nintendo Entertainment System (of which I am now a proud owner, having been slightly too young to have one the first

time around) which was the company's first cartridge based system, this was the best selling console of it's time with 61.91 million units sold worldwide and is the company's

second best selling non handheld console behind the Nintendo Wii. Nintendo followed this up with the 16-bit Super Nintendo, then the 64-bit Nintendo 64, 128-bit

GameCube (the first use of optical disc for Nintendo) and The Nintendo Wii.

Nintendo is the longest lasting home console manufacturer, even

beating their once fiercest competitor Sega, who now make games for the

Nintendo Wii. They have over 4,000 employees worldwide and are one of the biggest video game companies on earth with offices all over the world, and with their current consoles

selling so well, they will only continue to grow.

Much more info can be found on

Wikipedia

Chris Thursfield

*Images from

Nintendo

Top

|

Recipe: Pastitsio (pasta baked with meat sauce) |

Ingredients:

2 teaspoons olive oil

1 onion, chopped

2 cloves garlic, crushed

200g button mushrooms, sliced

750g lean beef mince

400g can chopped tomatoes

2 tablespoons reduced salt tomato paste

125ml red wine

125ml reduced salt beef stock

1 teaspoon sugar

2 tablespoons chopped fresh, flat leaf parsley

350g ziti (long, fat, hollow dried pasta), or penne rigate

1 egg, lightly beaten

1 egg white, lightly beaten pinch nutmeg

White Sauce

1/3 cup polyunsaturated margarine

1/2 cup plain flour

750ml low or reduced fat milk

1 egg, lightly beaten

Method:

1. Preheat oven to 180 degrees. Spray a 35 x 25 cm ovenproof dish with cooking spray

2. Heat the oil in a large fry pan, add the onion and garlic and cook over a medium heat for 3 minutes or until the onion is soft and golden. Add the mushrooms and cook for 5 minutes or until brown and tender. Add the mince and cook until browned, breaking up any lumps that form.

3. Stir in the tomatoes, tomato paste, red wine, stock and parsley and bring to the boil. Reduce the heat, cover and simmer for 20 minutes. Stir in the sugar.

4. Cook the pasta in a large pot of rapidly boiling water until al dente (cooked, but still with a bite to it), drain well and put on the base of the prepared dish. Pour over the combined egg, egg white and nutmeg.

5. To make the white sauce Melt the margarine in a small pot, add the flour and cook for 1 minute or until golden. Remove from the heat and add the milk. Stir until smooth, return to the heat and stir until the sauce boils and thickens. Simmer for 3 minutes. Remove from the heat and cool before stirring in the egg.

6. Add half the white sauce to the meat sauce. Spread the meat white sauce over the pasta, then top with plain white sauce. Bake for 50 minutes or until golden. Allow to stand for 10 minutes before slicing.

*Recipe From heartfoundation.org.au

Chris Thursfield

Top

|

Did you know?

|

Jokes (101 ways to annoy people part 5):

1. Set alarms for random times.

2. Repeat everything someone says, as a question.

3. ONLY TYPE IN UPPERCASE.

4. Publicly investigate just how slowly you can make a "croaking" noise.

5. Honk and wave to strangers.

6. Buy a large quantity of orange traffic cones and reroute whole streets.

7. Change channels five minutes before the end of every show.

8. Wear your pants backwards.

9. Decline to be seated at a restaurant, and simply eat their complimentary mints by the cash register.

10. Begin all your sentences with "ooh la la!"

Useless Fact:

1. The only 15 letter word that can be spelled without repeating a letter is

"uncopyrightable".

2. Duelling is legal in Paraguay as long as both parties are registered blood donors.

3. The word "lethologica" describes the state of not being able to remember the word you want.

Brainteaser:

Q. A man is sitting in a pub feeling rather poor. He sees the man next to him pull a wad of $50 notes out of his wallet.

He turns to the rich man and says to him,

"I have an amazing talent: I know almost every song that has ever existed."

The rich man laughs.

The poor man says, "I am willing to bet you all the money you have in your wallet that I can sing a genuine song with a lady's name of your choice in it."

The rich man laughs again and says, "Ok how about my daughters name, Joanna Armstrong-Miller."

The rich man goes home poor. The poor man goes home rich.

What song did he sing?

Site:

I would like to start highlighting websites I have come across on my internet travels:

The Oatmeal

The oatmeal is a website with quite clever comics about life and funny happenings (he does use some bad language)...I particularly like

"Why I believe printers were sent from hell to make us miserable" &

"Why it's better to pretend you don't know anything about computers"

*Answer to brainteaser - Happy Birthday

*Joke from coolfunnyjokes.com, Fact from extremefunnyhumor.com, Brainteaser from creatingsynergy.com

Chris Thursfield

Top

Kind regards from the team at JPP.

If you have a friend or family member looking for property, please feel free to forward our newsletter on to them.

Don't forget to comment on our blog.

JPP are now on Facebook and Twitter...We will be updating them both frequently from now on.

For our overseas clients and visitors, JPP now has a website translator. Just scroll to the bottom of the homepage, click 'Translate this website'

select your language and then click 'Click here to return to the homepage'.

Having trouble viewing this newsletter? The online version with pictures is available Here.

Top

|