MARKET OVERVIEW

With clearance rates around 63% again recently, we can see ourselves settling

in for the winter sales season. This tends to be a time where volumes become

lower, and negotiations become far more intense. If supply drops off whilst

demand stays level, then pressure occurs in certain segments of the market.

Investors have well and truly come into the market place as there are more

distressed sales of property. Your choice regarding style and location of

property will be paramount in your success as a property investor.

There is much talk of the government trying to coax institutional investors

in to offering low cost, affordable housing to those people who need assistance.

This is not being offered to the average Mum and Dad investor, who by the way

own 80% of the rental properties. We also read everyday from the “property

advisors” spruiking positive geared property is selling well.

I am not a financial advisor; I only assist people once they have made the

decision to have some direct property in their investment portfolio. Personally,

I agree with this, but each person should seek the advice of a reputable

financial planning professional. There are two main ingredients in any

investment; Yield and Capital Growth. In layman's terms yield is the rent you

receive each week from the tenant and Capital Growth is the difference between

what you purchased the property for and what you sold it for. (Or what the

property is worth today).

For the purposes of this comment, I will be very simplistic. The average

property is seen as “negatively geared” if your interest on the mortgage and

other costs (rates, insurance, body corp. etc, called outgoings) is greater than

the income you receive from the tenants. Because the government sees this as a

net loss, it is treated like any business loss and you can reduce your taxable

income because of this. When the tenants' rent outweighs the interest and

outgoings it is deemed positively geared and these funds will be added to

whatever other earnings you have and taxed accordingly.

Most areas where the capital growth rates tend to be at the higher levels

(the more established suburbs of major cities, where there is good

infrastructure) unfortunately usually have the lowest yield (%return). The

opposite is also true. Where the capital growth is limited because of distance

to infrastructure and not as many people wanting to live there, the rental

return tends to be higher.

So which is better? Higher yield and lower capital growth or vice versa? If

you can afford to negatively gear (where you will need to contribute out of your

own pocket each month to make up the shortfall in interest) and you achieve good

capital growth, I believe this will offer the greatest benefit if you wish to

grow your property portfolio. If you have limited capital growth then the only

way to get the deposit for your next property is to save, rather than use the

equity (capital growth) from your current investment property.

Go to our “how

to” series on our website to read more about Yield vs. Capital Growth in the

coming weeks.

Ian James

SAM'S FACTS

This month, something for Sports Lovers!!!

Brownlow Fact: The very first winner received only 7 votes because at this

time only one vote was awarded per match by the media. It wasn't until about 10

years after the 1924 Brownlow that umpires would award the votes.

Source: Funtrivia.com.au

The answer to the question in the April newsletter is:

Question : How many cars did Nicholas Cage have to steal in the movie Gone in

60 Seconds? 25, 50, 75,or 100?

Answer: 50 cars in just one night!

Question: Where & When was Ricky Ponting Born (The Australian Cricketer, for

those like me who don't follow much sport!!)

The answer to this question will be published in the next newsletter.

Sam James

LETTING THE HEART RULE THE HEAD

When searching for the ‘right property at the right price', adding an

emotional factor to the equation can often create additional dilemmas when

trying to secure the ideal property. With an investor the head usually rules the

heart in such matters, and it is simply a case of ticking the ‘right boxes' to

ensure the purchase will reap rewards over the long term. Owner occupiers

working within a restricted budget will inevitably get caught up with the need

to buy a property that feels like ‘home' as their first priority. As a result

they can often end up making a poor long term investment.

Once a buyer has ‘fallen in love' with a property, the process can become an

emotional roller coaster of despair. As a result the heart will often firmly

rule the head when it comes to negotiation and signing on the dotted line.

When I was working in real estate sales, I can't tell you the amount of times

someone would quote the old saying of ‘signing my life away' when it came to

filling out contracts. There are always nerves involved during the purchase of

real estate – let's face it, for most people it is the largest amount of money

they will ever commit to spending in one go! However with a bit of due diligence

and careful thinking, the process can become an enjoyable one, rather than one

resulting in sleepless nights and packets of Panadol!

Sitting down and discussing the options you have, and what you plan on

getting out of your purchase over the long term should be top of the list before

you even begin to look for a home. I often find the hardest hurdle to overcome

during the search process is finding out exactly what a buyer is looking

for. The purchasers who have taken the time to really think about their various

options are the ones that are truly ready and confident to move quickly when

needed - therefore greatly reducing the possibility of missing out to another

interested party.

Missing out can result in impulse buying. A well used real estate sale trick

is to grab the under-bidder at an auction and take them to view another house.

Agents know that the potential purchaser's emotions in this situation are ripe

for a quick sale.

Clarifying your needs prior to searching reduces the chances of making a

‘heart over head' mistake. Real estate should ideally have an investment factor

involved. You are committing a large amount of money and various sacrifices to

your life style in order to pay the mortgage, so it would be good to know you

are getting a good investment that will profit over the long term.

If you can't afford the locations you would ideally like to live in, think

about buying an investment property and renting for a period of time. You may

find that property investment is the first step to achieving your home-ownership

goals. A good investment property can often provide the needed equity to enable

you to borrow more a little further down the track.

Buying a property that won't appeal to every Tom, Dick and Harry will obviously

reduce buyer competition. Think about avoiding the fully renovated homes that

have the hefty ‘wow' appeal. These are designed to fuel emotions, and emotions

make ‘good auctions'. Take the time to research what your long term living needs

really are, and start concentrating on a property that has a good potential

floor plan and location, rather than something that has instant appeal.

There is enough information in the market place and ‘property professionals'

willing to assist when it comes to deciding your best plan of attack. Better

still, consider using a buyer advocate who can give you peace of mind to know

that the choices you make are good for the long term.

It is essential that you take the time to decide what you can afford and what

your options are before you start looking and getting emotionally caught

up with personal desire.

Putting a system into place means that the buying process can become an

enjoyable and hopefully speedy one.

Catherine

Cashmore

FISHING WESTERNPORT

With my boat nearly back in the water I am looking at getting amongst the big

Gummys. Anyone who hasn't seen the videos by Brendon Wing catching Gummy shark,

Mulloway and Snapper based on Western Port, should get a copy and have a look.

Technically, they may not be brilliant, but I can vouch for most of their

methods and a lot of the areas they target.

Winter fishing on Western Port is all about picking the right days to go out.

We have some beautiful mornings and overnight for that matter, but make sure you

cloth yourself against the cold and check weather forecasts often.

Fresh baits of couta, salmon and squid will give you the best chance on

mulloway, gummy and seven gill shark.

Good luck with your fishing.

Ian James

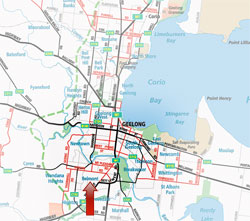

SPOTLIGHT ON MELBOURNE SUBURBS

In our regular spotlight section we examine a selection of Melbourne suburbs,

highlighting what's happening in these areas right now.

Belmont

Council: Geelong City Council www.geelongcity.vic.gov.au

Post Code: 3216

Area: 9.2km²

Population: 13,646 (2006 Census)

Neighbouring Suburbs: Grovedale, Highton, Newtown

Median House Prices

| |

Lower

Quartile |

Dec 07

Median |

Upper

Quartile |

Dec 06

Median |

Annual

Change |

| Belmont |

$245,000 |

$270,000 |

$310,500 |

$258,000 |

4.7% |

| Source: REIV. |

|

Click for larger map |

Belmont is a suburb of Melbourne's second largest city: Geelong. Belmont is

located 3km south east of Geelong's centre. The Barwon River runs along the

North and East side of Belmont.

Belmont is one of Geelong's largest, oldest and most popular suburbs. With a

population of approximately 13,600 (2006), Belmont has one of the largest and

busiest strip shopping centres. Belmont is also close to Deakin University.

Belmont was settled in 1836 by Dr Alexander Thomson. It wasn't until 1865 that

Belmont began to expand; three hotels, a flourmill, tanneries and a court of

petty sessions were built. By 1927 an aerodrome was built and a tram service to

Geelong ran (this ceased in 1956). The residential growth boom in Belmont really

grew after World War II and during the 1950's and 60's.

Public transport in Belmont is primarily by bus, with a number of local

services linking to local areas and the V/line country rail network, as well as

direct coach services to Torquay, Lorne and Apollo Bay.

Rental Analysis: Belmont

| Median Advertised weekly rent |

Gross rental yield (%) |

| $245 per week |

4.9% |

Figures for 12 months to

End of February 2008.

Source: Australian Property Monitors. |

Courtney James

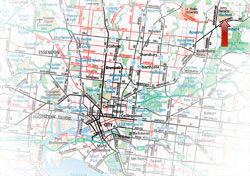

Macleod

Council: Banyule City Council: www.banyule.vic.gov.au

Post code: 3085

Area: 2.7 km²

Population: 8083 (2006 Census)

Neighbouring Suburbs: Yallambie, Watsonia, Rosanna, View bank

Median House Prices

| |

Lower

Quartile |

March 08

Median |

Upper

Quartile |

Dec 07

Median |

March 07

Median |

Quarterly

Change |

Annual

Change |

| Macleod |

$380,000 |

$435,000 |

$530,500 |

$447,000 |

$338,375 |

-2.7% |

28.6% |

| Source: REIV. |

|

Click

for Larger Map |

Macleod is a small North Eastern suburb, located about 18klm from Melbourne.

It is established residential area with a small commercial area. Macleod is

bounded by the southern edge of Gresswell Forest Wildlife Reserve, Wattle Drive

and Harborne Street in the north, the transmission line, Yallambie Road and

Greensborough Road in the east, Finlayson Street, Stanton Crescent, Chapman

Street and Ruthven Street in the south, Waiora Road and Cherry Street in the

west. Click here for an interactive map via Google maps. Part of the suburb of Macleod is located in

Darebin City.

Major features of the area include Banyule Netball Stadium, Macleod Shopping

Centre, Macleod Park, Harry Pottage Reserve and two schools.

Macleod's main public transport option is Macleod railway station, which is

located on the Hurstbridge railway line. Journey time to the CBD is about 30

minutes. Macleod is a 'premium' station, meaning that it is fully staffed from

first train to last, seven days a week. Macleod station also serves as a major

hub for more than 20 local bus routes.

Macleod is named after Malcolm Macleod, an early land holder. Settlement of

the area dates primarily from the early 1900s. Significant development did not

occur until the post-war years. Development in the western section continued

into the 1970s. The population has been relatively stable since the mid 1990s, a

result of some new dwellings being added but a decline in average household

size.

Rental Analysis: Macleod

| Median Advertised weekly rent |

Gross rental yield (%) |

| $320 per week |

4.3% |

Figures for 12 months to

End of February 2008.

Source: Australian Property Monitors. |

Sam James

HOW TO BUY PROPERTY IN MELBOURNE

The following is a special pre-release extract from our latest 'how-to'

article. For the full series, please visit and bookmark How to buy property in Melbourne. Be sure to re-visit on a regular basis

for all the latest articles!!

Negotiation: a Buyer's perspective, Part 1.

Most real estate agents that you speak to have a reasonable amount of

experience but very little theory knowledge when it comes to legislation

that surrounds their industry. The vast majority of agents the public deals

with are Agents Representatives. This represents a six day course at the

REIV. Most of their ongoing training is based on their company's mentor and

internal training programs. Some of these are very good and others are sadly

lacking in structure and content.

As such you will come across a vast range of good, average and poor

negotiators in your Real Estate quest. If you are negotiating against a

professional, fully licensed Real Estate Agent, who is the agency principal

or one of its directors, you are in competition with somebody who would be a

“Queen's counsel” in the legal fraternity. Good Luck! This agent is probably

involved in a couple of hundred property negotiations each year, similar to

what we are involved with. When you are negotiating with someone who has

superior knowledge of the industry and vastly more experience, then the idea

is to “keep your eye on the prize.” Always work out your “walk away” point

and stick to it.

When dealing with the average Agent's Representative, you still need to

keep your mind on when to walk away, but don't be too scared in asking

questions. Most of the time inexperienced agents are as nervous as you are

when they are negotiating. I can remember back when I was selling, how

incredibly worried I was about losing a prospective buyer by asking for too

much money or asking for a difficult settlement.

One of the first things you need to decide is how much risk you wish to

take and what rewards that will achieve. If you have found the perfect

property that suits all your needs, and the agent is asking a fair and

reasonable price, then it is probably not the time to give a “one off” low

price and say “take it or leave it”. There is too much risk of losing the

property. Words you can live buy whilst buying property; “Paying $5000 more

for a great property is far better than saving $10,000 on a poor one”

In a flat or “down-turned” market, agents are far more likely to be

cautious when it comes to shutting down and offer. If you have ever dealt

with a Victorian inner city agent, in the peak of a sellers market, any

offer you try to push prior to auction will usually be dismissed out of hand

unless it is absolutely ridiculously over the top. We will deal with this

scenario in another topic. Whether the property is being offered at public

auction, private sale, “sale by set date”, “tender” or any one of a thousand

other euphemisms, a legally binding deal can be reached once the vendors'

statement (Section 32) is available. In any negotiation you are involved in

you must try and exercise some control. This doesn't mean you try to be

difficult for the sake of it, nor does it mean speaking “louder” to get your

point across. I am sure we have all seen the person who thinks that if he

shouts louder, he gets his point across easier.

Some of the ways of wresting some control from the agent are:

a) setting the timing of the meeting to put in an offer

b) setting the timing of when the deposit will be paid

c) talking about a slightly different settlement time than the agent had

first mooted

There are many other ways of doing this and you shouldn't try for every

one of these. Don't make the agent think you are a pain for the sake of it.

Just try and make sure the agent sees you as a negotiator, not a follower.

Do you have a question, comment or 'war story' regarding your experiences

in buying or selling property? If so, we would like to hear about it; email [email protected]. We are always happy

to offer advice; selected stories will be highlighted in future articles.

Ian James

RECIPE

Honey Joys

Here's one for the kids: a foolproof recipe that can be put together in just

minutes from ingredients you probably already have.

My children always enjoy

making these with mum, but they love eating them even more!

Ingredients:

- 1/4 cup honey

- 4 cups cornflakes

- 60 gms butter

- 1 tblsp sugar

- 24 patty cases

|

|

Method:

- Place the honey, butter and sugar in a large sauce pan and heat until

they melt together.

- Remove from heat, add cornflakes and mix well.

- Place spoonfuls of the mixture into patty cases.

- Bake in a low oven at 150c for 10 minutes.

- Allow to cool and serve immediately.

A simple and delicious treat that everyone loves!

Craig Hart

STAFF UPDATE

It is with some regret that we announce the departure of Justin Lilburne from

the JPP team. Justin is moving on to other opportunities, and I know he

will be missed by everyone. We thank him for his time

at JPP, and wish him well in his future endeavours.

Kind regards from the team at JPP.

Having trouble viewing this newsletter? The online version with pictures, is available here

Contact Us

JPP Buyer Advocates

368 Hawthorn Road

Caulfield South 3162

P: 03 9523 1054 F: 03 9523 1082

E: [email protected] W: www.jpp.com.au

|