Don’t believe everything you read

There are many commentators that have an agenda when they write comments for the mainstream media to pick up. Some are looking for notoriety and others may be looking for business. Many in the media will write articles for the papers and the internet having no idea what they are writing about or what the validity of the source is. They will regurgitate anything somebody else has said to fill their brief for their deadline. The more sensational, the more likely it is to be read.

So, to hear the claims that property will be dropping 10%, 20% 30% r even 40% and the media bothers to print this is ludicrous. It would take a “Chernobyl” incident for the property market to do this and it has never dropped 40% of its value. To do so would render our banks without any security or the ability to even function, our entire economy would most likely fall apart.

In fact, over the next couple of years the exact opposite is much more likely to occur. Yes, the market is softening at the moment because banks are fearful of further repercussions with irresponsible lending and have erred on being over cautious whilst they are still in the spotlight of the Royal Commission. However, this will pass soon and whilst we do not want to see irresponsible lending, I think the banks will set a balance between responsible lending and making a profit for their shareholders.

Once the banks free up lending again, we go back to the current market fundamentals. We have massive population growth, and this is highly unlikely to change in the near future. This assure a greater demand than supply for many years to come. We have exceptionally low unemployment. Most people who want work can currently get it. And finally, we have relatively cheap money and nobody is forecasting a rise in interest rates anytime soon.

The population growth and low unemployment are here to stay almost regardless of what the government does in the short term. We can reduce immigration, we can force immigrants to rural areas when they arrive, we can even have a reduction in the natural population growth due to cost of housing and education of our children. But none of this matters in the next 10 years. Almost everything that happens in the next ten years is a result of what happened in the 1950’s & 1960’s: BABY BOOMERS.

People who are 55 to 65 years old now will be retiring on mass over the next decade. They will create massive employment in the services industry. They will also be leaving high paying jobs that need to be filled. Most of these Baby Boomers are in Melbourne and Sydney and that is where most jobs will need to be filled and where most new services jobs will need to be created. You can land people into rural Australia or smaller capitals around the country, but you cannot stop them coming to Melbourne or Sydney where the jobs and ultimately the money is.

With these attributes, once lending is more accessible, we will see growth catch up almost instantly and over the next decade a doubling of property prices from their current levels. And I know many people say that property prices cannot keep going up, but they have for as long as there has been property ownership (We can track back about ten centuries to 1066 when the Normans invaded England and brought with the titles) The average growth rate for land is around 7% which means property will double about every 10 years. This is not special, in fact it is ultra conservative.

I know it is very difficult to get finance at the moment, but anyone who can, it is a perfect time to be starting your property portfolio. There are properties out there, that are nearly revenue neutral so it won’t matter if the new federal government stops negative gearing. There are many properties out there that you can value add or develop.

If you are considering a change of property, or looking for that next investment property, please feel free to drop by for a chat or give us a call.

Ian James

Director

JPP Buyer Advocates

|

|

JPP Property Management

Well we are settled into our new office and loving it.

Our previous office was in a shop on Nepean Hwy Carrum,

Great location with the beach behind us, however Sky rail is due to start right outside that shop.

Which after watching the time and disruption that occurred in Murrumbeena we opted to MOVE!

We are now located in the Patterson Lakes shops, (which is only 5mins from where we were).

We are in a lovey office building, (it is upstairs – which by the end of the day, that is a negative for me, not the young ones)

Our office is fresh and bright and larger than where we were, so it is a great working environment for us all.

Feel free to pop in, Suite 3/100 Gladesville Blvd.

(Above the bottle shop and subway, that smell of freshly cooked bread doesn’t help the waistline!!).

Sam James

|

|

Real Estate Institute of Victoria Awards for Excellence 2018

At this year’s Real Estate Institute of Victoria Awards for excellence Courtney Thursfield became the youngest ever recipient of the President’s Award. This is the only category for the night that you cannot nominate yourself for. It is the quintessential award for the evening.

Courtney joined the REIV in 2007 as an agent’s representative and became a fully licensed estate agent in 2009.Courtney’s tireless efforts at the REIV as well as throughout the industry have made her a leader in her field. She sits on members council and several committees with the REIV. She has been requested to assist Consumer Affairs Victoria with a number of new initiatives.

After 10 years in the industry and working with her peers as well as with the incumbent government, Courtney has vast experience to be able to handle all the facets of Property Management.

I would also like to congratulate the rest of the winners in their chosen categories for the year.

|

|

Property Spruikers are not Buyer Agents

Rick Otton of We Buy Houses Pty Ltd has had the Federal Court impose fines totalling $18m for making false and misleading representations about how people could create wealth through buying and selling real estate. The penalties were imposed against both the company and Mr Otton personally after the action was brought forward by the ACCC.

There are plenty of ways to make money out of property. But most of the time due to the entry and exit cots, the vast majority of money made will be over time. You can value add to property and you can develop land. Both of these may make some money, but over time, property is a fantastic asset that will usually make you a lot of money.

But when somebody tells you can:

- Buy a house for $1, without needing a deposit, bank loan or real estate experience, or using little or none of their own money.

- Create passive income streams through property and quit their jobs.

- Build a property portfolio without their own money invested, new bank loans or any real estate experience.

- Start making profits immediately and create or generate wealth.

These are the statements that We Buy Houses had made and that the Federal Court found to be misleading.

I property advisor is not there to tell you that you should buy property. We are there to assist you to find, assess and secure a property that will suit your goals. You may be after higher growth with some sacrifice on yield. It could be that you would like to get a very good yield, as close to revenue neutral as possible. Or you may be trying to find something that you can add value to or develop.

Either way, a buyers’ advocate should be able to give you good advice on the type style and location of a property that will suit your game plan. We are very good at assessing the market and working out what to pay. We are also expert negotiators.

A buyers advocate can help you secure property. They should not be trying to sell you an idea or a “system” Just remember that when something sounds to good to be true, it probable is.

Ian James

Director

JPP Buyer Advocates

|

|

Preventative Maintenance – Gutter Cleaning

With all of the trees out in bloom and plenty of beautiful foliage around, now is a good time to look at cleaning out those gutters. Gutters are a grey area under legislation and we suggest landlords cover the cost of getting these cleaned on an annual to bi annual basis, just depending on the location of your property and what’s around.

Having the gutters cleaned is not an enormous expense. Most plumbers will complete this for between $150 and $250, it may be a little dearer for a double storey.

There are many benefits to cleaning the gutters, and for a landlord they all involve avoiding damage to the property. Blocked gutters can not only cause water to over flow out of the gutters at the property and add extra stress, but it can also allow the water to flow inside the roof cavity. The damage can occur very slowly with water in the roof cavity, there will be some slight discolouration to start with, once that begins the water will pool and eventually come through the ceiling. Having someone clean the gutters also offers an opportunity to have a look at their condition.

If the property is in a very high tree area then we would suggest cleaning the gutters more regularly and potentially trimming back anything on the landlords side of the fence that is causing an issue.

Gutters are on our checklist at routine inspections and we have asked tenants to watch out for any blockages and to let us know as soon as possible if they are concerned.

If you would like any more information about gutter cleaning please contact us at [email protected].

Courtney Thursfield

|

|

Could this be the future for Vintage Vehicles?

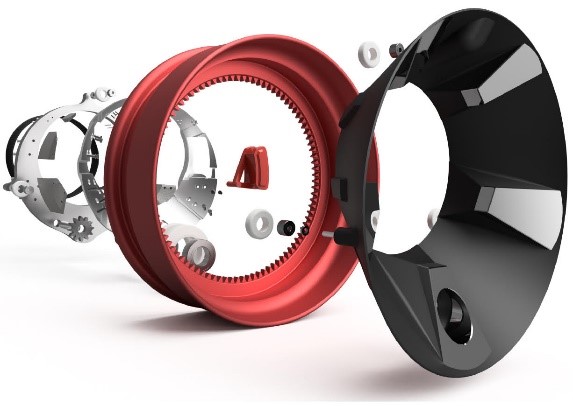

As an avid car enthusiast, I own several vehicles and as with most several are in parts! Why? tinkering and modifying them for speed, fun or just because its something different however the biggest pain point for most vintage car owners is drivetrain, original engines are hard to come by and often if you do they are overpriced and unreliable at best. So what're the options? an engine swap? been there, doing that.

How about turning it into an Electric Vehicle, whilst maintaining the vintage exterior appeal; purist would be turning in their graves, however, luckily for me I believe that cars should be driven and not tucked away to rot. Now your thinking but that would be a small fortune? It was until Orbis Ring Drive.

Recently at Sema; a California-based startup Orbis Driven unveiled a standalone electric DC motor bolts directly onto your existing suspension uprights these add up to 75hp-100hp per wheel Direct Drive with no transfer case, no differential, no driveshafts, and the bonus of regenerative braking (charging), improved performance, improved fuel economy. This would allow for vintage cars to remain on the roads with very minimal modification, increase reliability and remove the need for inefficiency and the high cost of maintenance. Its great to see forward thinking and new hope for the vintage market!

Read more here: Orbisdriven

Justin Lilburne

Image from orbisdriven.com

|

|

Have you decided to sell a property?

JPP Buyer Advocates now offer Vendors the same Expert Advice we offer our Buyers; We become your middle man and make sure that you get the Right Advice.

|

Buying now may be the right time

Buying the right property at the right time is a great way to set you up for the future. Selling a property at the right time for the right amount is just as smart.

|

Are you a landlord?

JPP manage and lease properties all of Melbourne and the Mornington Peninsula. We take care of all of your investment property needs through our property management service.

|

Subscribe?

Let us keep you updated and informed of the state of the market. Please go to our website and update your contact details.

|

|

You have received this email because you have subscribed to the JPP Newsletter. If you no longer wish to receive emails please unsubscribe

|

|

© 2018 JPP Buyer Advocates, All rights reserved

|

|